Figuring out your take-home pay in a new country can feel like solving a puzzle. If you’re an expatriate, a digital nomad, or a local employee in Albania, the question “How much will I actually earn?” is critical. Unlike a simple flat tax, Albania’s system is progressive, meaning different parts of your income are taxed at different rates. Add social contributions to the mix, and it gets complicated fast.This guide is designed to be your manual, breaking down the exact steps to calculate your net salary. While online calculators are fast, understanding the how and why gives you true financial control. We’ll explore the new tax laws, contribution caps, and walk through a real-world example together.

Table of Contents

- Key Terms: Gross vs. Net Salary

- Albania’s Personal Income Tax Brackets (Effective Jan 2024)

- The Crucial First Step: Social & Health Contributions

- Putting It All Together: A Step-by-Step Calculation Example

- What About Business or Investment Income?

- Why Bother Calculating This Manually?

Key Terms: Gross vs. Net Salary

Before we dive in, let’s get our vocabulary straight. These terms are the building blocks of your paycheck.

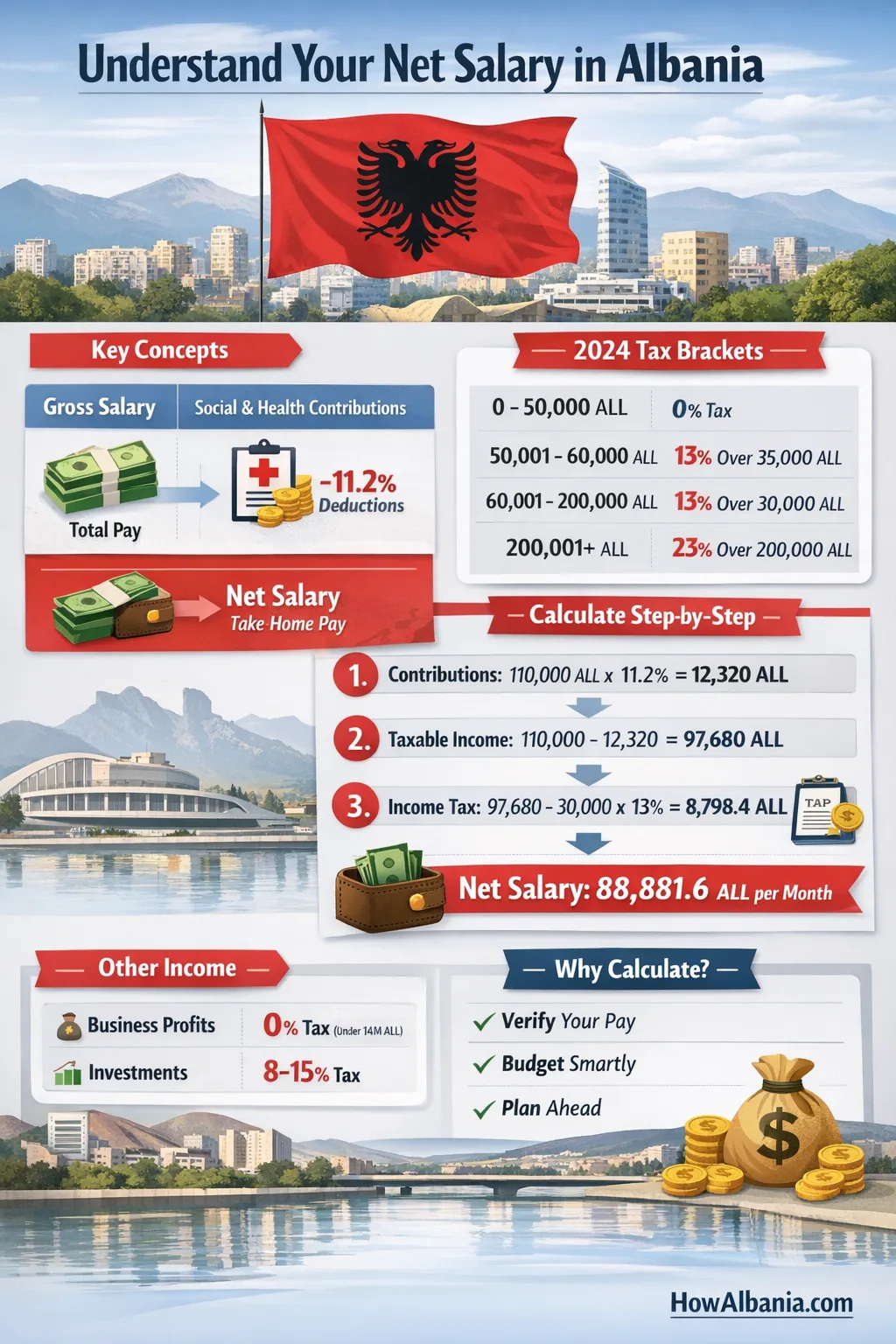

- Gross Salary (Paga Bruto): This is the total amount of money your employer agrees to pay you before any deductions. It’s the top-line number in your employment contract.

- Social Contributions (Sigurimet Shoqërore): A mandatory payment to fund pensions and social support. Both you and your employer pay a share.

- Health Contributions (Sigurimet Shëndetësore): A mandatory payment for the public health insurance scheme.

- Taxable Income (Të Ardhurat e Tatueshme): This is not your gross salary. It’s your Gross Salary minus your total Social and Health Contributions. This is the figure used to calculate your income tax.

- Net Salary (Paga Neto): This is the “take-home” pay. It’s the amount that actually lands in your bank account after all contributions and taxes have been deducted.

Albania’s Personal Income Tax Brackets (Effective Jan 2024)

Albania introduced a new income tax law (No. 29/2023) that became effective on January 1, 2024. This law updated the progressive tax brackets for employment income. Understanding these brackets is the key to the entire calculation.

The tax is calculated based on your monthly taxable income (remember: Gross Salary – Contributions).

| Monthly Taxable Income (in ALL) | Tax Rate / Calculation |

|---|---|

| 0 – 50,000 | 0% (No tax) |

| 50,001 – 60,000 | 13% of the amount over 35,000 ALL |

| 60,001 – 200,000 | 13% of the amount over 30,000 ALL |

| 200,001 and above | 22,100 ALL + 23% of the amount over 200,000 ALL |

*Note: The 50k-60k bracket is unusual. It’s a specific calculation (Income – 35,000) * 13%, designed as a transition.

The Crucial First Step: Social & Health Contributions

This is the part most people miss. You cannot calculate your tax without first deducting your contributions. These contributions are also capped, meaning you only pay them up to a certain salary level.

Employee’s Share (Deducted from your Gross Salary)

- Social Security: 9.5%

- Health Insurance: 1.7%

- Total Employee Contribution: 11.2%

The Contribution “Base” (The Cap)

This is extremely important. You don’t pay 11.2% on your entire salary if it’s very high. As of 2024, the contributions are calculated on a salary (base) between:

- Minimum Base: 40,000 ALL

- Maximum Base: 176,416 ALL

What does this mean?

- If you earn 30,000 ALL (below min), your contribution is calculated on the 40,000 ALL minimum.

- If you earn 100,000 ALL (in the middle), your contribution is calculated on your full 100,000 ALL.

- If you earn 250,000 ALL (above max), your contribution is only calculated on the 176,416 ALL cap.

Putting It All Together: A Step-by-Step Calculation Example

Let’s walk through a real-world scenario. Meet “Alex,” who just got a job offer with a Gross Monthly Salary of 110,000 ALL.

Step 1: Calculate Social & Health Contributions

Alex’s salary (110,000) is between the 40,000 min and 176,416 max, so we use the full 110,000 as the base.

- Calculation: 110,000 ALL * 11.2% (or 0.112)

- Total Contributions: 12,320 ALL

Step 2: Determine the Taxable Income

This is the gross pay minus the contributions we just calculated.

- Calculation: 110,000 ALL (Gross) – 12,320 ALL (Contributions)

- Taxable Income: 97,680 ALL

Step 3: Calculate the Personal Income Tax

Now we use the tax brackets table with our 97,680 ALL taxable income. This amount falls into the “60,001 – 200,000” bracket.

- Bracket Rule: 13% of the amount over 30,000 ALL

- Calculation: (97,680 ALL – 30,000 ALL) * 13% (or 0.13)

- Calculation: 67,680 ALL * 0.13

- Income Tax: 8,798.4 ALL

Step 4: Find the Final Net Salary

This is the final step! We take the Gross Salary and subtract both the contributions and the tax.

- Calculation: 110,000 (Gross) – 12,320 (Contributions) – 8,798.4 (Tax)

- Alex’s Net Salary: 88,881.6 ALL per month

What About Business or Investment Income?

It’s important to know that employment income is treated separately from other income sources.

- Business Income: If you are a self-employed individual (“person fizik”), your business profit is taxed differently. Many small businesses with a turnover under 14 million ALL per year may benefit from a 0% tax rate until 2029.

- Investment Income: Income from dividends is taxed at a flat 8%, while other income like rent, royalties, or capital gains is typically taxed at 15%.

Why Bother Calculating This Manually?

In the age of instant online tools, why do the math? Because an “Income Tax Calculator Albania” is only as good as the data put into it. By understanding the process, you can:

- Verify Job Offers: Accurately compare gross salary offers and know your true financial standing.

- Budget with Confidence: Base your monthly budget on a number you know is correct.

- Spot Errors: Check your official payslip (“lista e pagave”) to ensure the calculations are correct.

- Plan for the Future: Understanding how a raise will affect your net pay helps you negotiate more effectively.

Disclaimer: This article is for informational and educational purposes only, based on tax laws as of 2024. Tax legislation can and does change. While we strive for accuracy, this guide is not a substitute for professional financial or legal advice. For decisions regarding your personal finances, please consult with a certified Albanian accountant or tax advisor.